Tax Reform

Switzerland’s prosperity is based on two key pillars: internationally competitive business taxation and a reliable old age pension system. Corporate tax reform was necessary, as some tax privileges were no longer in line with the requirements of the international community.

Switzerland has therefore abolished these various schemes. The various replacement measures that were put in place in 2020 are nevertheless a fundamental asset for Switzerland’s attractiveness.

They enable the maintenance of an attractive and internationally competitive business tax.

For example:

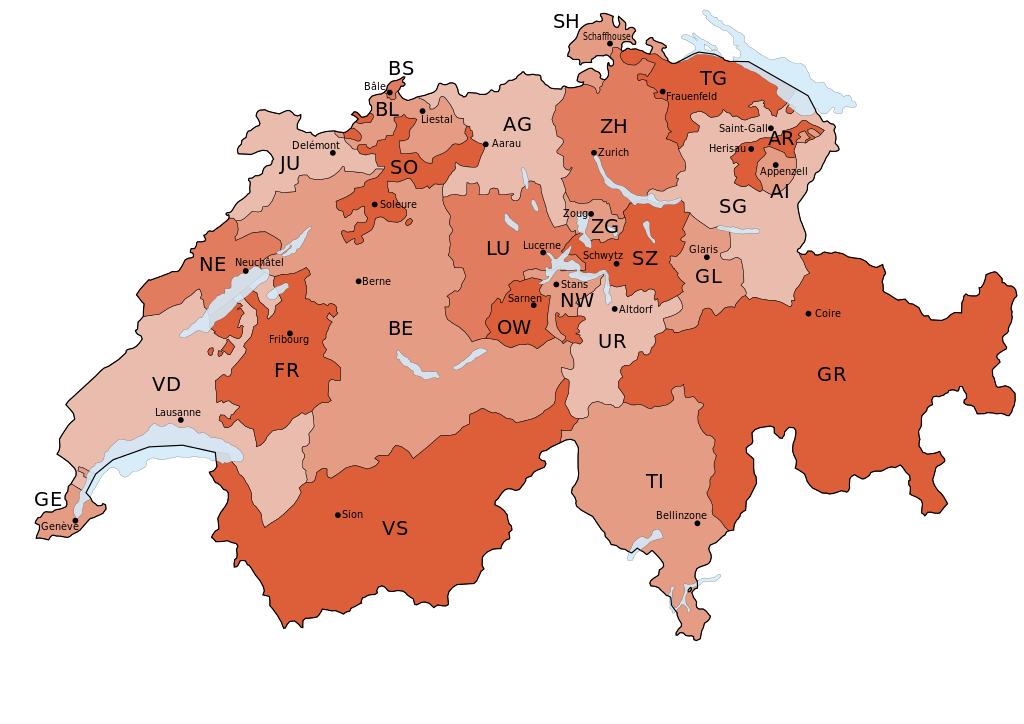

Here are the percentage of corporate taxes in the cantons where we are located:

- Canton de Vaud : 13.79%

- Canton de Lucerne : 12.32 %

With regard to holdings, the privileged regime has been abolished, but there remains the “compensation regime” which favours a virtually zero tax on dividend returns from subsidiaries.

Many other tax benefits exist.

We will provide accurate tax information for each client file studied.